Home » Financial Improvement Financial Improvement

Are you looking to learn the basics of financial improvement? We offer articles and information to help you learn more about constructive management of your money.

While we do not provide financial advice, we offer general information about the concepts you need to understand when managing your finances.

Are you looking to learn the basics of financial improvement?

Financial Advice Disclaimer

The information contained on the Good Improvements website is not financial advice.

All website content and the resources available for download through this site is not intended as, and shall not be understood or construed as, financial advice.

The content producers for Good Improvements are not legal, accounting or financial professionals.

The information contained on this Website is not a substitute for financial advice from a professional who is aware of current facts and circumstances of your individual situation.

What Is Financial Improvement?

Financial improvement refers to the process of enhancing an individual’s or organization’s financial situation. This can involve increasing income, reducing expenses, or both.

Financial improvement can also involve improving credit scores, reducing debt, building savings, and investing wisely to achieve long-term financial goals.

The ultimate goal of financial improvement is to achieve financial stability and security, enabling individuals and organizations to live within their means, manage unexpected expenses, and plan for the future.

Financial improvement can be achieved through a variety of methods, including budgeting, investing, debt reduction, and increasing income streams.

How can I be financially smart?

What does financial success look like?

How can I achieve financial freedom in my life?

What is the 50/30/20 rule for Budgeting?

What are some good financial goals?

What is the safest investment strategy?

How to make money work for you

How can I grow my money fast?

What are poor money habits?

How much should you have in an emergency fund?

How Can I Improve Myself Financially?

Improving your financial situation takes time and effort, but the rewards are worth it.

Start by taking small steps and stay committed to your financial goals. There are several ways you can improve yourself financially.

Here are some steps you can take:

Create a budget:

Start by creating a budget that accounts for your income and expenses. This will help you understand where your money is going and identify areas where you can cut back.

Reduce unnecessary expenses:

Look for areas where you can reduce your expenses, such as eating out less, cancelling subscriptions you don’t use, and finding ways to save on utilities.

Pay off debt:

If you have debt, focus on paying it off as soon as possible. Start by paying off high-interest debt first, such as credit card debt.

Build an emergency fund:

Create an emergency fund that can cover three to six months of living expenses. This can help you avoid going into debt in case of unexpected expenses or income loss.

Increase your income:

Consider ways to increase your income, such as taking on a part-time job, freelancing, or starting a side business.

Invest for the future:

Consider investing in stocks, bonds, or real estate to build wealth over the long term.

Seek financial education:

Read books or attend courses on personal finance to learn more about managing your money and making informed financial decisions.

Understanding The 50 30 20 Budget Rule

The 50/30/20 budget rule is a popular budgeting method that involves dividing your income into three categories: needs, wants, and savings.

The 50/30/20 budget rule is a simple and flexible way to allocate your income and prioritize your spending.

It allows you to cover your essential needs, enjoy some discretionary spending, and save for your future.

Keep in mind that this budgeting method may not work for everyone, and you may need to adjust the percentages based on your personal circumstances and financial goals.

Here’s how it works:

50% for Needs:

This category includes essential expenses such as rent or mortgage payments, utilities, food, transportation, and insurance. These are expenses that are necessary for your basic living needs.

30% for Wants:

This category includes discretionary expenses such as dining out, entertainment, hobbies, and shopping. These are expenses that are not essential for your basic needs, but add enjoyment and fulfillment to your life.

20% for Savings:

This category includes any money you save, invest, or put towards debt repayment. This could include building an emergency fund, contributing to a retirement account, or paying off high-interest debt.

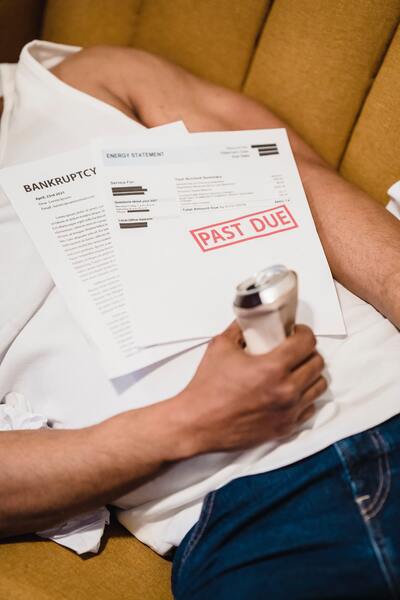

What To Do When You’re Financially Struggling?

Financial struggles can be temporary and there are steps you can take to improve your situation.

Don’t be afraid to reach out for help and take action towards improving your financial health.

If you’re financially struggling, there are several steps you can take to improve your situation:

Create a budget:

Start by creating a budget that accounts for your income and expenses. This will help you understand where your money is going and identify areas where you can cut back.

Reduce unnecessary expenses:

Look for areas where you can reduce your expenses, such as eating out less, cancelling subscriptions you don’t use, and finding ways to save on utilities.

Prioritize bills:

Prioritize paying essential bills, such as rent/mortgage payments, utilities, and insurance, before other expenses.

Seek assistance:

If you’re struggling to make ends meet, look for assistance programs that can help, such as food banks, utility assistance programs, and rental assistance programs.

Increase your income:

Consider ways to increase your income, such as taking on a part-time job, freelancing, or starting a side business.

Talk to creditors:

If you’re having trouble making payments on debts, talk to your creditors and explain your situation. They may be willing to work out a payment plan or offer temporary relief.

Seek financial education:

Read books or attend courses on personal finance to learn more about managing your money and making informed financial decisions.

What Are The Main Types Of Financial Management?

Financial management can be broadly classified into two types:

Personal financial management:

This type of financial management involves managing an individual’s personal finances, including budgeting, saving, investing, and managing debt. It involves creating a plan to achieve personal financial goals such as buying a home, saving for retirement, or paying for education.

Corporate financial management:

This type of financial management involves managing the finances of a business or organization, including budgeting, financial planning and analysis, risk management, and capital budgeting. It involves creating financial strategies to maximize profits and shareholder value, manage risk, and ensure the financial stability of the organization.

Both types of financial management require skills such as financial analysis, strategic planning, and risk management, but they differ in terms of the scope and objectives of financial decision-making.

Personal financial management focuses on achieving individual financial goals, while corporate financial management focuses on achieving the financial objectives of a business or organization.