Understanding poor money habits is the first step to identifying ways in which you can improve your money habits.

Find out more about common bad money habits and how to make the change to improving the way you deal with money.

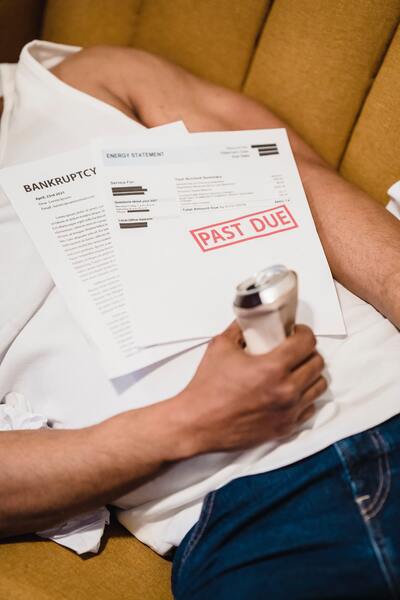

10 Bad Money Habits to Avoid

Habits are the things we do over and over again without even thinking. Both good and bad habits shape our lives for the better or worse. Therefore, breaking bad money habits and developing better financial habits are important.

Breaking bad money habits is challenging and takes time. However, you can start transitioning to better money habits with the right approach and persistence. Here are some of the bad money habits you should avoid to attain your financial goals:

i. Spending more than you earn

Whether you are employed or own a business, it is important to live within your means. Spending more than you earn is a mistake most people make and has serious financial effects. If you spend more than you earn, you end up relying on credit to survive.

You will notice that getting debts and credit card bills will become a norm for you trying to make ends meet. Most people who spend more than they earn are always in debt affecting their future financial freedom.

If you spend more than you earn monthly, try to cut your budget (spend less) or find an alternative source of income to supplement your earnings. Always spend less than you earn while saving at least 20% of your monthly income.

ii. Relying on credit to pay the bills

We all rely on debt at some point to pay for the mortgage, education, hospital bills, or buy an investment property.

Be that as it may, avoid relying on credit cards or any other form of debt to pay your bills. Sometimes avoid expensive or unnecessary purchases, for example, fancy vacations, to save money. If you are planning to treat yourself, ensure the spending is within your budget.

iii. Paying your bills late

Late payments are a common financial mistake and can have long-lasting consequences on your wallet and credit score. Paying your bills late comes with additional fees that can affect your budget. Remember, missed payments and late payments can lower your credit score.

Paying the bills on time helps you avoid any additional costs. Did you know that paying your bills on time gives you peace of mind and helps you plan your finances better? To avoid paying the bills late, you can enroll in auto pay or have someone else take care of the bills on your behalf.

iv. Taking out payday loans

Payday loans are the worst forms of debt because of their interest rates. If you find yourself applying for a payday loan, you must get your financial affairs in order.

Most people prefer taking payday loans because they are easy to access. However, they have a short repayment period, and their interest rates are very high. Instead of taking a payday loan, find other sources of income or different ways you can come up with the money to take care of your needs.

v. Failing to educate yourself about personal finance

Familiarizing yourself with personal finances is crucial to make responsible and educated decisions. Poor financial literacy predisposes one to make poor financial decisions.

However, if you know what you should and should not do, you can invest in the right businesses. Luckily, there are numerous online reading materials to help you get started.

vi. Not building up an emergency fund

Anything can happen, and you can have a financial crisis if you are not prepared. Preparing for an emergency is important to avoid unnecessary debts or stress.

After setting a budget and tracking your monthly spending, start putting money away for an emergency fund. The goal is to save 3 – 6 months of expenses in an emergency fund to cover any unexpected events. The emergency fund comes in handy in case of an accident, or you lose your job.

One of the worst feelings in the world is failure to pay for emergencies like home repairs or a broken-down car. Start saving a small amount of money each month, and by the end of the year, you will have made good progress.

vii. Failing to save for the future

With an established budget and an emergency fund, the next thing is to save for retirement. While it is good to have fun, saving for the future is crucial, especially if your employer matches the retirement contributions.

However, consider enrolling in one if your employer does not have a retirement plan. You can contribute to Roth Individual Retirement Account (IRA) to save for retirement. With a maximum contribution of $6,000, you can invest or save the leftover cash for the future after maxing out the annual retirement contribution.

viii. Not investing in insurance

Investing in insurance, for example, health, auto, and home or renters insurance, is advisable in case the unthinkable happens.

Anything can happen in a blink of an eye, and with insurance, you can get coverage when you need it the most. Choose the best insurer and coverage options depending on your budget and insurance needs.

ix. Not having a career plan

If you are not employed or do not like your job, you can make a change for the better. With a career plan, you can earn more money and take control of your financial situation.

Therefore, if you think your current employer is not paying you what you are worth, consider asking for a raise or applying for better-paying jobs in other companies.

x. Not setting financial goals

Setting financial goals helps you work towards achieving them. We all have different financial goals in life. Some people are looking to be debt free, while others are looking to buy a house or a car.

Whatever your financial goals are, they can motivate you to avoid bad money habits and achieve your financial goals.

Embracing good money habits will help you achieve the financial freedom you desire. Saving money, paying your bills early, and creating a financial plan will positively impact your spending behaviors and, eventually, your financial success.